Economic Policy Made Easy: What It Means for Your Wallet

Ever wonder why prices go up or why the government decides to build a new highway? That's economic policy at work. In simple terms, it’s the set of rules and actions that a country uses to manage money, jobs, and growth. Think of it as the playbook a government follows to keep the economy humming without major hiccups.

What Is Economic Policy?

Economic policy is a broad umbrella that covers everything a government does to influence the economy. It includes decisions on taxes, how much to spend on public services, how to regulate banks, and even how to handle trade with other nations. The main goal? To create a stable environment where businesses can thrive, people can find work, and prices stay reasonable.

There are two big pieces you’ll hear a lot about: fiscal policy and monetary policy. Both aim to balance the economy, but they work in different ways and are handled by different parts of the government.

Key Tools: Fiscal vs. Monetary

Fiscal policy is all about government spending and taxes. When the economy looks weak, the government might cut taxes or increase spending on projects like roads or schools. That puts more money in people’s hands and can jump‑start hiring. On the flip side, if inflation (prices rising too fast) is a problem, the government may raise taxes or cut back on spending to cool things down.

Monetary policy, on the other hand, is managed by the central bank – in India, that’s the Reserve Bank of India (RBI). The central bank controls interest rates and the money supply. Lower interest rates make borrowing cheaper, encouraging businesses to expand and consumers to spend. Higher rates do the opposite, helping to tame inflation.

Both policies can work together or at odds. For example, if the RBI raises rates to fight inflation but the government is also cutting spending, the combined effect can be a strong slowdown. That’s why coordination between fiscal and monetary authorities is crucial.

Let’s look at a real‑world example. In 2022, many countries faced soaring energy prices. Governments responded with fiscal measures like subsidies for households and tax breaks for energy‑intensive industries. At the same time, central banks nudged interest rates up to keep inflation in check. The mix aimed to protect consumers while avoiding a runaway price spiral.

Another common tool is tax reform. Changing tax rates can influence how much people work, save, or invest. A lower corporate tax might attract foreign companies, creating jobs. Conversely, higher taxes on luxury goods can curb excessive spending and raise revenue for public services.

Public spending isn’t just about roads and schools. It also includes health care, social security, and disaster relief. When the government invests in these areas, it can boost overall productivity – healthier workers, better‑educated youth, and stronger safety nets.

So, how does this affect you day‑to‑day? If the government decides to build a new highway near your town, you might see more construction jobs and easier travel. If the central bank raises rates, your mortgage or car loan payments could go up. Understanding the basics helps you see why certain news headlines matter.

In short, economic policy shapes the big picture of jobs, prices, and growth. It’s a balancing act between spending, taxing, and controlling money. By keeping an eye on fiscal moves (like budgets) and monetary shifts (like interest rates), you can get a clearer sense of what’s coming next for your wallet and your community.

Next time you hear about a new budget or a rate hike, remember it’s part of the larger economic policy plan. Knowing the why behind these moves makes it easier to plan your own finances, whether you’re saving for a house or just budgeting for groceries.

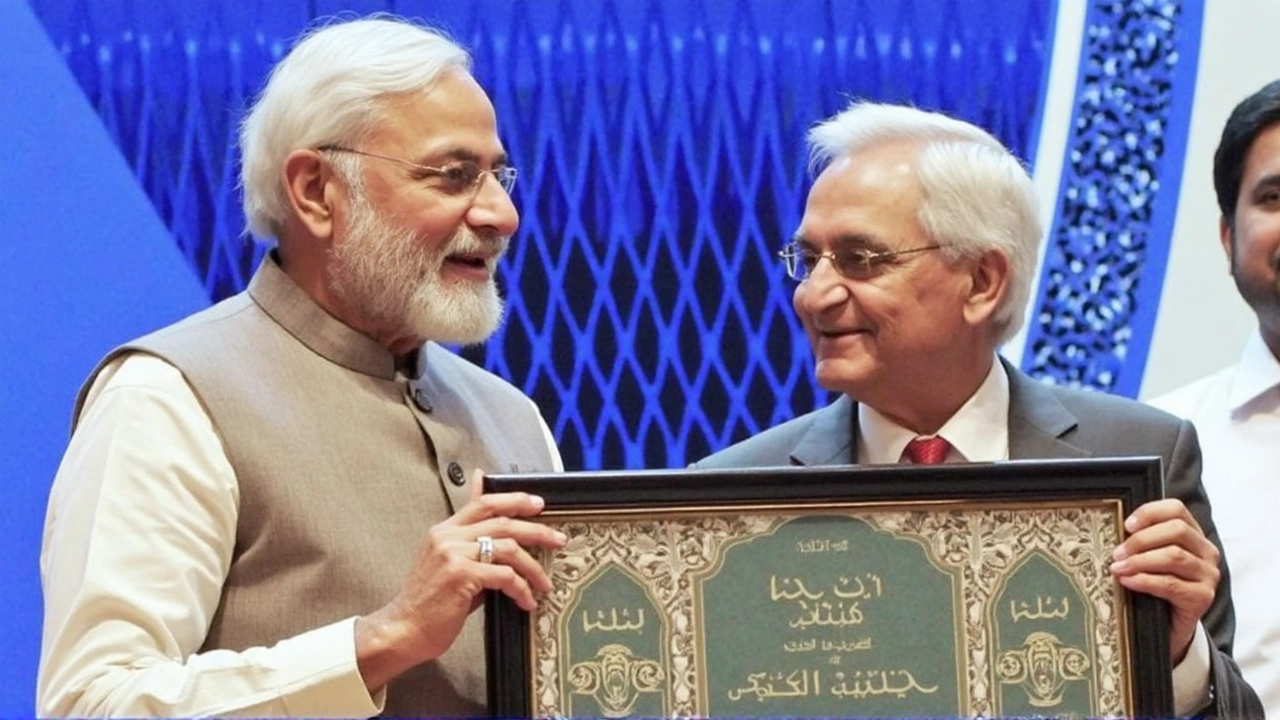

Ex-RBI Governor Shaktikanta Das Joins PM Modi's Team as Principal Secretary

Shaktikanta Das, former Reserve Bank of India Governor, has been appointed as Principal Secretary-2 to Prime Minister Modi, joining Pramod Kumar Mishra in this unique dual-role setup. Known for his extensive experience within the financial sector, Das's appointment aims to bolster India's economic strategy despite concerns from the opposition regarding political bias.