RBI Governor – The Person Behind India’s Money Moves

Whenever you hear about interest rates climbing or falling, it’s usually the RBI Governor who’s at the helm of the decision. The Governor is the chief executive of the Reserve Bank of India, the country's central bank. He or she sets the direction for monetary policy, oversees currency issuance, and makes sure banks play by the rules. In plain English, the Governor decides how cheap or expensive money is for everyone – from big businesses to the guy next door.

Right now, the Governor is Shaktikanta Das, who took office in December 2018. He’s known for pushing a balanced approach: keep inflation in check while supporting growth. Over the past year, he’s tackled rising fuel prices, nudged the repo rate down to 6.5%, and championed digital payments to make banking easier for the common person.

What the RBI Governor Does Every Day

First up, the Governor chairs the Monetary Policy Committee (MPC). This group meets every two months to decide the repo rate – the benchmark that banks use to price loans and deposits. When the repo rate changes, your home loan EMI, savings account interest, and even credit card charges feel the ripple.

Second, the Governor supervises the banking system. If a bank looks shaky, the RBI steps in, often at the Governor’s direction, to protect depositors. This oversight also includes setting capital requirements, ensuring banks have enough cash on hand, and promoting financial inclusion through schemes like Jan Dhan Yojana.

Third, the Governor handles the country’s foreign exchange reserves. By buying or selling dollars, the RBI stabilises the rupee’s value. A stable rupee means cheaper imports, which can lower the price of everyday items like oil and electronics.

Why It Matters to You

When the Governor announces a rate cut, you’ll notice lower EMIs on your home loan or personal loan. Savings accounts may also earn a tad more, but the difference is usually small. Conversely, a rate hike makes borrowing costlier, which can slow down big purchases like cars or house upgrades.

Bank holidays are another practical area. The RBI decides the official holiday calendar for banks across India. For example, during Janmashtami 2025, most banks were closed, but digital services like UPI and online banking kept running. Knowing the holiday schedule helps you plan payments, avoid missed due dates, and schedule cash withdrawals.

Inflation is hot on the Governor’s agenda. If inflation spikes, the RBI may raise rates to cool spending. That could mean higher grocery prices in the short term, but it protects your buying power over the long run. Watching the Governor’s speeches on inflation gives you a heads‑up on upcoming price trends.

Lastly, the Governor pushes for new technology in banking. Initiatives like the Unified Payments Interface (UPI) and digital rupee pilots stem from his office. These tools make instant payments possible, cut down on cash handling, and open up new ways to save and invest.

In a nutshell, the RBI Governor’s decisions ripple through every corner of the Indian economy. Whether you’re planning a big purchase, saving for the future, or just checking your bank balance, staying aware of his moves can help you make smarter money choices.

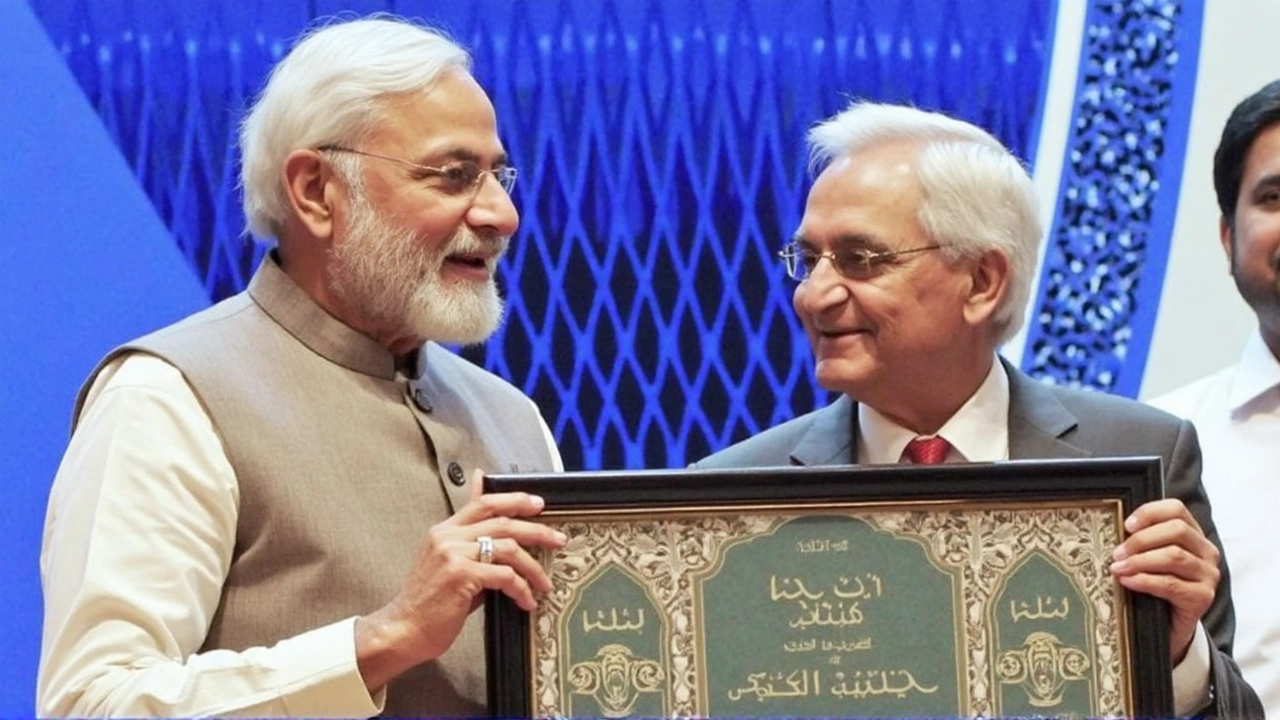

Ex-RBI Governor Shaktikanta Das Joins PM Modi's Team as Principal Secretary

Shaktikanta Das, former Reserve Bank of India Governor, has been appointed as Principal Secretary-2 to Prime Minister Modi, joining Pramod Kumar Mishra in this unique dual-role setup. Known for his extensive experience within the financial sector, Das's appointment aims to bolster India's economic strategy despite concerns from the opposition regarding political bias.

Shaktikanta Das: Unveiling the Unseen Wealth of the Former RBI Governor in His New Role with PM Modi

Shaktikanta Das, who served as the 25th Governor of the Reserve Bank of India, now plays a crucial role as Principal Secretary to PM Modi. Despite the mystery surrounding his financial status, his significant contribution to India's economic stability is evident through his key policy implementations and crisis management strategies. Das's transition continues to spark interest, highlighting his journey from financial policymaker to political advisor.

Shaktikanta Das: A Strategic Appointment as Principal Secretary to PM Modi

Shaktikanta Das, former RBI Governor, has been designated as Principal Secretary-2 to PM Modi, introducing a new role in the administrative hierarchy. With a background spanning several economic reforms, including GST and demonetisation, and international representation like G20 and IMF, Das brings vital fiscal expertise. This strategic appointment is poised to fortify India’s economic maneuvering in light of global uncertainties.

Former RBI Governor Joins PM Modi's Team as Principal Secretary for Economic Strategy

Shaktikanta Das, ex-RBI Governor, steps into a vital role as Principal Secretary-2 to PM Modi, building on his wealth of experience in finance and governance. With his new position coinciding with Modi's term, Das aims to fortify economic policies, having previously managed India's financial landscape through demonetization and the pandemic.

Shaktikanta Das Steps into Dual Role as Principal Secretary-2 to PM Modi

Shaktikanta Das has been appointed as Principal Secretary-2 to Prime Minister Narendra Modi, a historic development for the PM's Office. Das previously served as RBI Governor, managing crucial economic shifts such as demonetization and the COVID-19 pandemic. His role focuses on bolstering economic strategies alongside the current Principal Secretary, PK Mishra.