Economic Repercussions of Today’s Headlines

If you’ve been scrolling through news feeds, you’ve probably seen headlines about U.S. tariffs, stock market rallies, and new weather alerts. All of these might seem unrelated, but they share one thread: they each cause economic repercussions that touch everyday life. In this guide we’ll break down the most important impacts and show you what they mean for your wallet.

Tariffs and Trade Tensions

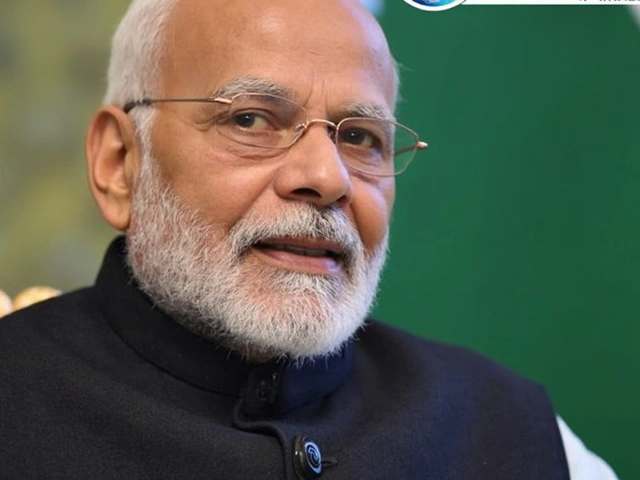

The United States just slapped a 50% tariff on Indian imports, citing India’s oil purchases from Russia. That move isn’t just a diplomatic jab – it pushes up prices for clothes, shoes, and other goods that travel from India to U.S. shelves. Indian exporters feel the squeeze, which can lead to lower production, job cuts, or a shift to cheaper markets.

At the same time, a U.S. appeals court struck down most of former President Trump’s tariffs, but left steel and aluminum duties intact. The partial win keeps some protectionist pressure on Indian steel exporters while opening doors for other sectors. Companies that relied on cheap U.S. steel now face higher input costs, and those in consumer goods may see a slight price dip.

What does this mean for you? If you shop online for Indian-made products, expect a possible price bump on the next order. If you run a small business that imports from India, keep an eye on your supplier contracts – you might need to renegotiate or explore alternative sources.

Market Moves and Inflation Trends

India’s Sensex and Nifty recently surged after retail inflation fell to an eight‑year low of 1.55%. Lower inflation usually means your purchasing power improves, and investors feel more confident, pushing stock prices up. The rally was led by healthcare stocks and boosted by domestic institutional buying, even though foreign investors kept selling.

While the market cheer sounds good, the rapid rise can also bring volatility. If you’re new to investing, a sudden jump might tempt you to buy at the peak. Remember, markets can swing back quickly, so stick to a plan and avoid chasing hype.

Another piece of the puzzle is the NSDL IPO, which listed at a 10% premium and jumped over 35% in two days. Such a strong debut shows appetite for financial sector stocks, but it also means more capital flowing into the market, potentially inflating valuations. For everyday savers, this could be a sign to diversify – think mutual funds or bonds to balance risk.

Beyond stocks, the weather alerts across Delhi, Kolkata, and Uttar Pradesh affect local economies. Heavy rains cause traffic snarls, waterlogging, and temporary business closures. That translates to lost sales for street vendors and higher logistics costs for companies, which can edge up product prices.

Bottom line: every headline – be it a tariff decision, a market surge, or a weather warning – creates ripples that reach your bank account. Stay informed, watch how these events influence prices, and adjust your budget or investment strategy accordingly.

Keep checking this tag page for fresh updates on economic repercussions. We’ll keep cutting through the jargon and give you the practical takeaways you need to make smarter financial choices.

Trump Escalates Global Trade Tensions with New Tariff Policies

President Trump has increased tensions in global trade by implementing a 10% universal tariff, with increased rates for 60 nations. These policies impact key sectors like steel and automobiles, provoke retaliation from the EU, China, and Canada, and aim to address trade imbalances and national security, although critics warn of economic consequences.