Panic Strikes Indian Markets as Global Trade War Escalates

If you checked your trading app on April 7, 2025, you probably felt your heart sink a little—or a lot. Indian stock markets just lived through a day they’ll be talking about for years as the Sensex tanked almost 4,000 points (down a brutal 5.22%) to close below 71,500. The Nifty didn’t fare any better, nose-diving over 1,100 points (5.06%). But this wasn’t just random market chaos—this was the ripple effect of something much bigger brewing overseas.

The trigger? A fresh burst of US-China tariffs, delivered in classic shock-and-awe fashion. With President Trump slapping hefty tariffs on a new raft of Chinese imports and Beijing immediately firing back, investors worldwide scrambled. Suddenly, the anxiety wasn’t just about two superpowers going at each other, but about how their tussle could pull everyone else into a messy global slowdown.

- The fear factor: India’s volatility index, the so-called India VIX, shot up by a staggering 52%. If there was ever a red flag for market terror, this was it. Think of VIX as a measure of how jittery everyone is; spiking to 21 meant nerves were seriously fraying.

- Sector shockwaves: This wasn’t limited to a handful of random stocks. Tech, finance, and auto giants in the Indian market all got slammed. Tata Motors sank nearly 8%, Infosys nearly 7%, and even the usually rock-solid HDFC Bank took a beating. The mood? Practically everyone headed for the exits.

- Foreign Flight: With headlines screaming “trade war,” international investors (those FPI folks who can move markets in minutes) started pulling out. When foreigners bail, Indian stocks get clubbed twice as hard.

Stabilizers Step In: RBI and SEBI Move to Douse the Flames

The crash was ugly enough that India’s financial regulators couldn’t just watch. The Reserve Bank of India began buying rupees to stop the currency from sliding off a cliff. Meanwhile, SEBI tightened rules—like curbing short sales and tweaking limits on certain derivatives—to stop panic sellers from making things spiral even further.

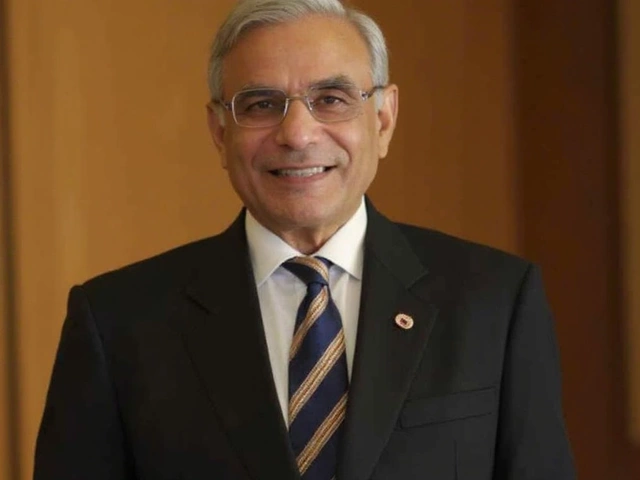

But here’s where it gets more interesting. Market veterans and analysts, like Geojit’s Dr. VK Vijayakumar, suggest this pain might be short-lived. Sure, the initial tariff drama sent everyone for cover, but there’s hope that negotiations—especially between India and the US—could dial down some of those tariff threats. Vijayakumar’s advice to jittery investors? Sit tight, watch carefully, and resist the urge to dump everything at once. The broad view is that India’s economic fundamentals are in much better shape than some others in the region.

Does that mean we’re in the clear? Not exactly. Tariff battles can have aftershocks, especially for sectors heavy on exports or reliant on global capital. Still, many are betting that once the dust settles, the sell-off could end up looking, in hindsight, like a dramatic—but temporary—dip rather than the start of something much worse.

- Key casualties: Tech (like Infosys, Tech Mahindra), autos (Tata Motors), banking (HDFC Bank) all saw double-digit percentage drops intraday.

- Government interventions: RBI currency buys and SEBI trading curbs provided a bit of a safety net as the panic played out.

- VIX at fever pitch: A 52% jump in volatility signals the sheer uncertainty traders and long-term investors are facing.

So, if you saw your portfolio drop and wondered if the market is broken, you’re definitely not alone. The real test is whether the market can calm down enough for a rebound—or if more shocks are lurking just around the corner as this tariff fight unfolds abroad.