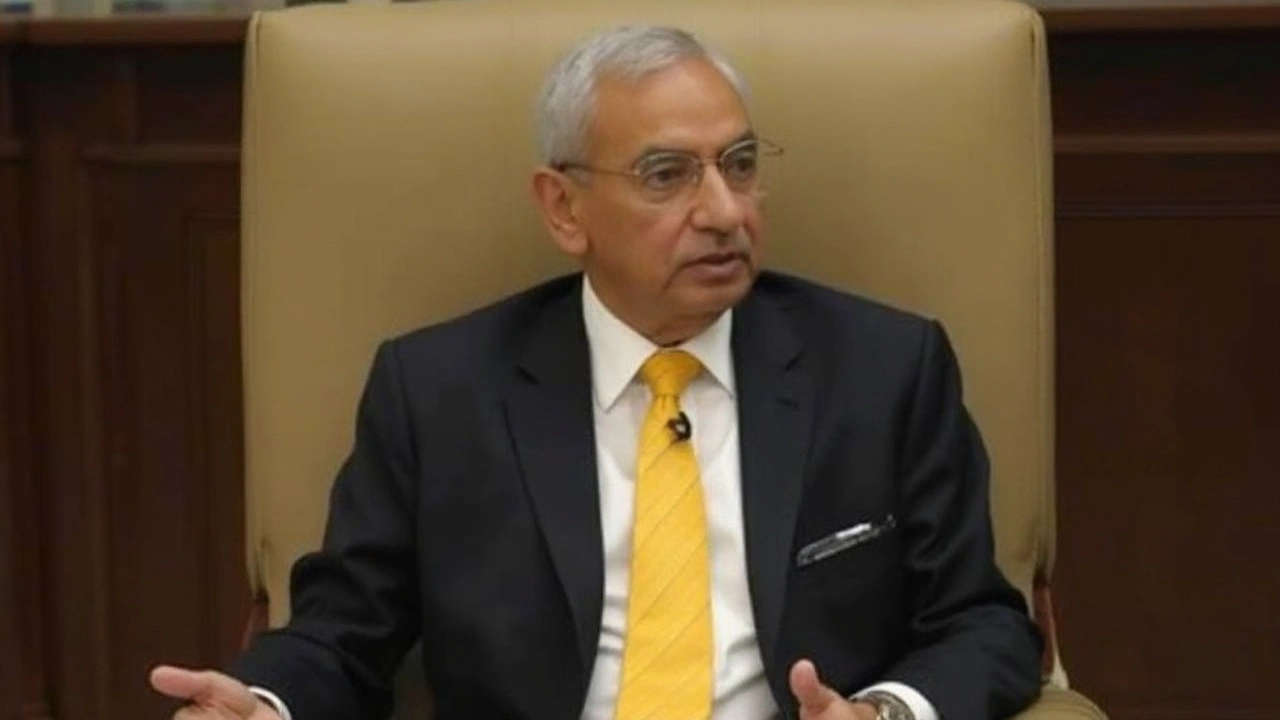

Shaktikanta Das – The Man Steering India’s Money System

If you’ve ever wondered why interest rates jump or why your savings earn a certain amount, the answer often leads back to Shaktikanta Das. As the Governor of the Reserve Bank of India (RBI), he decides how much money flows in the economy, which banks can lend, and how the rupee stays stable. In plain terms, he’s the guy who makes sure your money works for you and the country.

Who is Shaktikanta Das?

Shaktikanta Das started his career in the Indian Administrative Service (IAS) before moving to the RBI in 2002. After serving in various roles – like heading the Department of Banking Supervision – he became the Governor in December 2018. Since then, he’s faced big challenges: a pandemic, high inflation, and volatile global markets.

His style is simple – he talks about data, not politics. When inflation rises above the RBI’s 4% target, he may raise the repo rate (the rate banks pay to borrow from the RBI) to cool down price hikes. When growth slows, he can lower that rate to encourage borrowing and spending.

Why His Decisions Matter to You

Every time Das announces a policy change, it ripples through your daily life. A higher repo rate can mean pricier home loans or car loans, while a lower rate might make those loans cheaper. His stance on digital payments also affects how quickly you can pay bills online.

Recent news shows his influence beyond banking. For instance, when the US slapped a 50% tariff on Indian imports, the RBI under Das kept an eye on currency stability, preventing a sharp rupee fall. Similarly, during the retail inflation dip to an eight‑year low, Das’s steady hand helped markets like Sensex and Nifty climb, giving investors confidence.

He also guides how banks handle crises. During the recent Delhi rain alerts and monsoon floods, the RBI, under his direction, urged banks to extend loan moratoriums for affected borrowers, easing the burden on families stuck in water‑logged areas.

In short, Shaktikanta Das isn’t just a bureaucrat in a fancy office; his moves decide whether you pay more for groceries, get a better rate on your home loan, or see your savings grow faster.

Understanding his role helps you anticipate financial changes. Keep an eye on RBI press releases, especially around the bi‑annual monetary policy meetings. Those are the moments when Das explains why rates might go up or down, and they offer clues on what to expect for your pocket.

So next time you hear about “RBI policy” or “repo rate,” remember it’s Shaktikanta Das shaping those decisions. Knowing his approach can make you smarter about savings, loans, and everyday expenses.

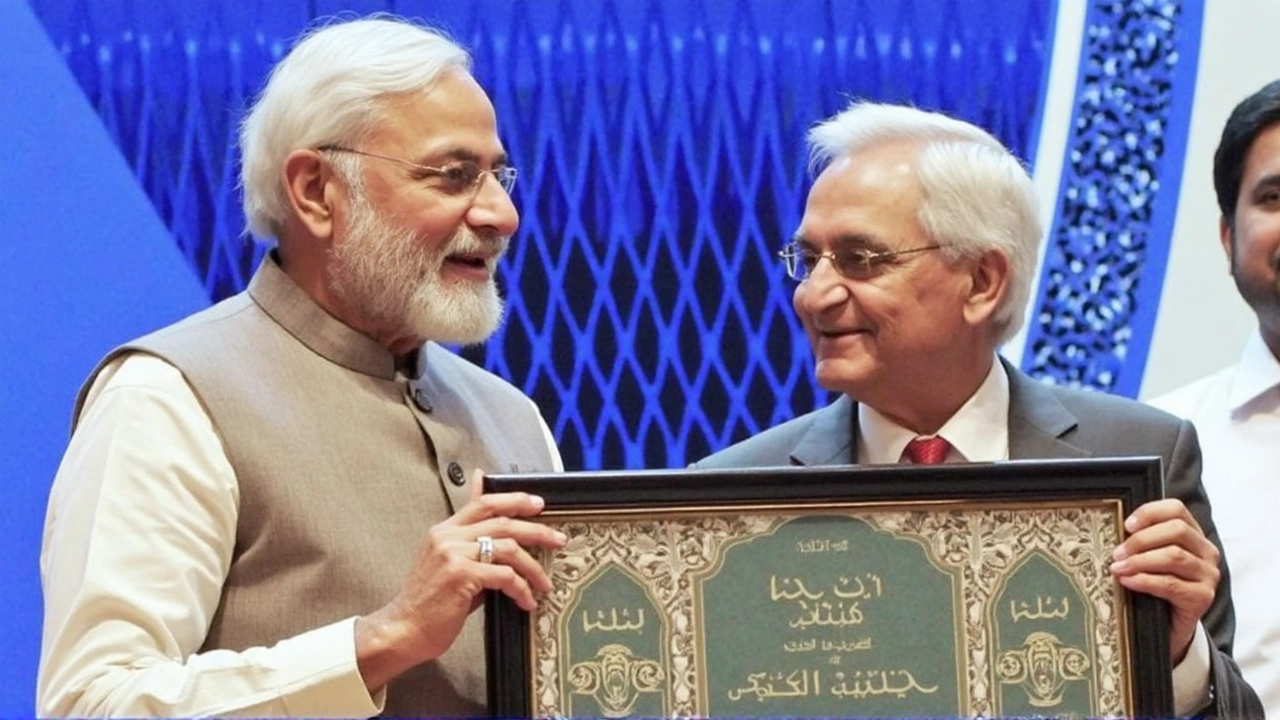

Shaktikanta Das Steps into New Role as Principal Secretary to PM Modi

Former RBI Governor Shaktikanta Das becomes Principal Secretary-2 to PM Modi, a first-time role. Known for handling demonetization and COVID-19 impacts, his expertise in fiscal matters aims to enhance economic strategy amidst global challenges. The appointment has sparked political debate.

Ex-RBI Governor Shaktikanta Das Joins PM Modi's Team as Principal Secretary

Shaktikanta Das, former Reserve Bank of India Governor, has been appointed as Principal Secretary-2 to Prime Minister Modi, joining Pramod Kumar Mishra in this unique dual-role setup. Known for his extensive experience within the financial sector, Das's appointment aims to bolster India's economic strategy despite concerns from the opposition regarding political bias.

Shaktikanta Das: Unveiling the Unseen Wealth of the Former RBI Governor in His New Role with PM Modi

Shaktikanta Das, who served as the 25th Governor of the Reserve Bank of India, now plays a crucial role as Principal Secretary to PM Modi. Despite the mystery surrounding his financial status, his significant contribution to India's economic stability is evident through his key policy implementations and crisis management strategies. Das's transition continues to spark interest, highlighting his journey from financial policymaker to political advisor.

Shaktikanta Das: A Strategic Appointment as Principal Secretary to PM Modi

Shaktikanta Das, former RBI Governor, has been designated as Principal Secretary-2 to PM Modi, introducing a new role in the administrative hierarchy. With a background spanning several economic reforms, including GST and demonetisation, and international representation like G20 and IMF, Das brings vital fiscal expertise. This strategic appointment is poised to fortify India’s economic maneuvering in light of global uncertainties.

Former RBI Governor Joins PM Modi's Team as Principal Secretary for Economic Strategy

Shaktikanta Das, ex-RBI Governor, steps into a vital role as Principal Secretary-2 to PM Modi, building on his wealth of experience in finance and governance. With his new position coinciding with Modi's term, Das aims to fortify economic policies, having previously managed India's financial landscape through demonetization and the pandemic.

Shaktikanta Das Steps into Dual Role as Principal Secretary-2 to PM Modi

Shaktikanta Das has been appointed as Principal Secretary-2 to Prime Minister Narendra Modi, a historic development for the PM's Office. Das previously served as RBI Governor, managing crucial economic shifts such as demonetization and the COVID-19 pandemic. His role focuses on bolstering economic strategies alongside the current Principal Secretary, PK Mishra.